Technology

India’s Robotics Landscape: Domestic Firms Rise Amid Global Competition

India is positioning itself as a significant player in the global robotics industry, with a reported installation of over 8,500 industrial robots in 2023, marking a substantial 59 percent increase from the previous year. Despite this growth, India’s robot density remains low at approximately 7 units per 10,000 workers, which contrasts sharply with China (392) and South Korea (1,012). The country’s vast population of 1.5 billion and the ambitious “Make in India” initiative present immense opportunities for robotics, leading to a key question: will domestic companies drive this future, or will foreign manufacturers dominate?

Foreign Investment Shapes Expectations

Several leading global robotics manufacturers, including ABB, Kuka, and Fanuc, have established operations in India. These companies introduce global standards and established product lines, supported by significant research and development. Noteworthy is Omron’s newly opened Automation Center in Bengaluru, which offers proof-of-concept facilities, training, and technical support, enhancing local manufacturing expectations.

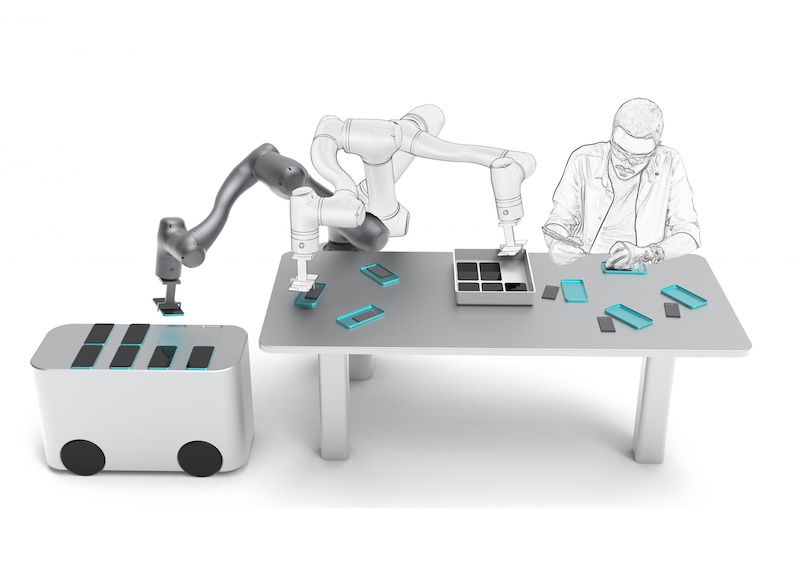

While foreign robots are well-established, their high costs may not suit India’s fragmented industrial base, primarily consisting of small and medium-sized enterprises (SMEs). This scenario has created a gap that domestic robotics firms are beginning to fill, focusing on affordable, robust systems with simplified integration and local support.

Among the notable players is GreyOrange, a multinational recognized for its warehouse robotics solutions. Another key company, Addverb Technologies, has gained traction through its partnership with Reliance Industries, one of India’s largest conglomerates, which has provided both capital and credibility for scaling operations.

Domestic Innovators Carve Unique Paths

The Indian robotics landscape features a diverse range of companies producing various machines, including mobile robots, drones, and industrial arms. For instance, Genrobotics has developed sewer-cleaning robots that replace hazardous manual scavenging practices, while Sastra Robotics and Planys Technologies have successfully exported advanced robotics systems tailored for specialized tasks.

India’s burgeoning drone industry is exemplified by firms like IdeaForge and Garuda Aerospace, which have attracted attention from both defense and commercial sectors. This diversity is crucial, as India’s industrial base—comprising millions of SMEs—will require tailored automation solutions distinct from those used by large automotive original equipment manufacturers (OEMs).

In the automotive sector, Indian manufacturers such as Tata, Mahindra, and Bajaj Auto are yet to make their mark as global giants, primarily due to inconsistent automation practices. Unlike their Chinese counterparts, Indian automakers focus on local demand, often accepting variations in manufacturing quality. However, significantly enhancing automation could position these companies for larger export markets, where uniformity and precision are paramount.

As automation technology becomes more accessible, the economic calculus is shifting. Collaborative robots, priced between $20,000 and $40,000, can operate continuously and outperform multiple workers, enhancing productivity and reducing error rates. This trend indicates a potential tipping point where SMEs may begin to view robotics as a viable investment rather than solely relying on labor.

The future of robotics in India will likely hinge on the competition between foreign OEMs and local innovators. Foreign firms provide proven technology and expansive networks, while domestic companies leverage local insights and cost advantages to adapt their offerings for Indian conditions. The success of companies like GreyOrange demonstrates that Indian firms can compete on a global scale, while others like Addverb and Genrobotics showcase the potential for niche markets.

As India navigates this pivotal moment, the outcome could define its role in the global robotics arena. Should domestic firms thrive, India may transition from a consumer market for imported robots to a significant exporter of robotics technology. Conversely, if foreign companies dominate, India risks being relegated to a secondary role in the robotics landscape. The next decade will be crucial as the nation balances its artisanal manufacturing heritage with the demands of industrial precision.

-

Technology4 months ago

Technology4 months agoDiscover the Top 10 Calorie Counting Apps of 2025

-

Health2 months ago

Health2 months agoBella Hadid Shares Health Update After Treatment for Lyme Disease

-

Health3 months ago

Health3 months agoErin Bates Shares Recovery Update Following Sepsis Complications

-

Technology3 weeks ago

Technology3 weeks agoDiscover 2025’s Top GPUs for Exceptional 4K Gaming Performance

-

Technology4 months ago

Technology4 months agoDiscover How to Reverse Image Search Using ChatGPT Effortlessly

-

Technology2 months ago

Technology2 months agoElectric Moto Influencer Surronster Arrested in Tijuana

-

Technology4 months ago

Technology4 months agoMeta Initiates $60B AI Data Center Expansion, Starting in Ohio

-

Technology4 months ago

Technology4 months agoRecovering a Suspended TikTok Account: A Step-by-Step Guide

-

Health4 months ago

Health4 months agoTested: Rab Firewall Mountain Jacket Survives Harsh Conditions

-

Lifestyle4 months ago

Lifestyle4 months agoBelton Family Reunites After Daughter Survives Hill Country Floods

-

Technology3 months ago

Technology3 months agoUncovering the Top Five Most Challenging Motorcycles to Ride

-

Technology4 weeks ago

Technology4 weeks agoDiscover the Best Wireless Earbuds for Every Lifestyle