Technology

Georgia Tech Researchers Evaluate AI’s Understanding of Financial Influencers

Researchers at Georgia Tech have developed a novel benchmark to assess how effectively artificial intelligence (AI) tools can interpret advice from financial influencers on platforms like YouTube. These influencers, referred to as “finfluencers,” play an increasingly prominent role in shaping investment decisions among their followers.

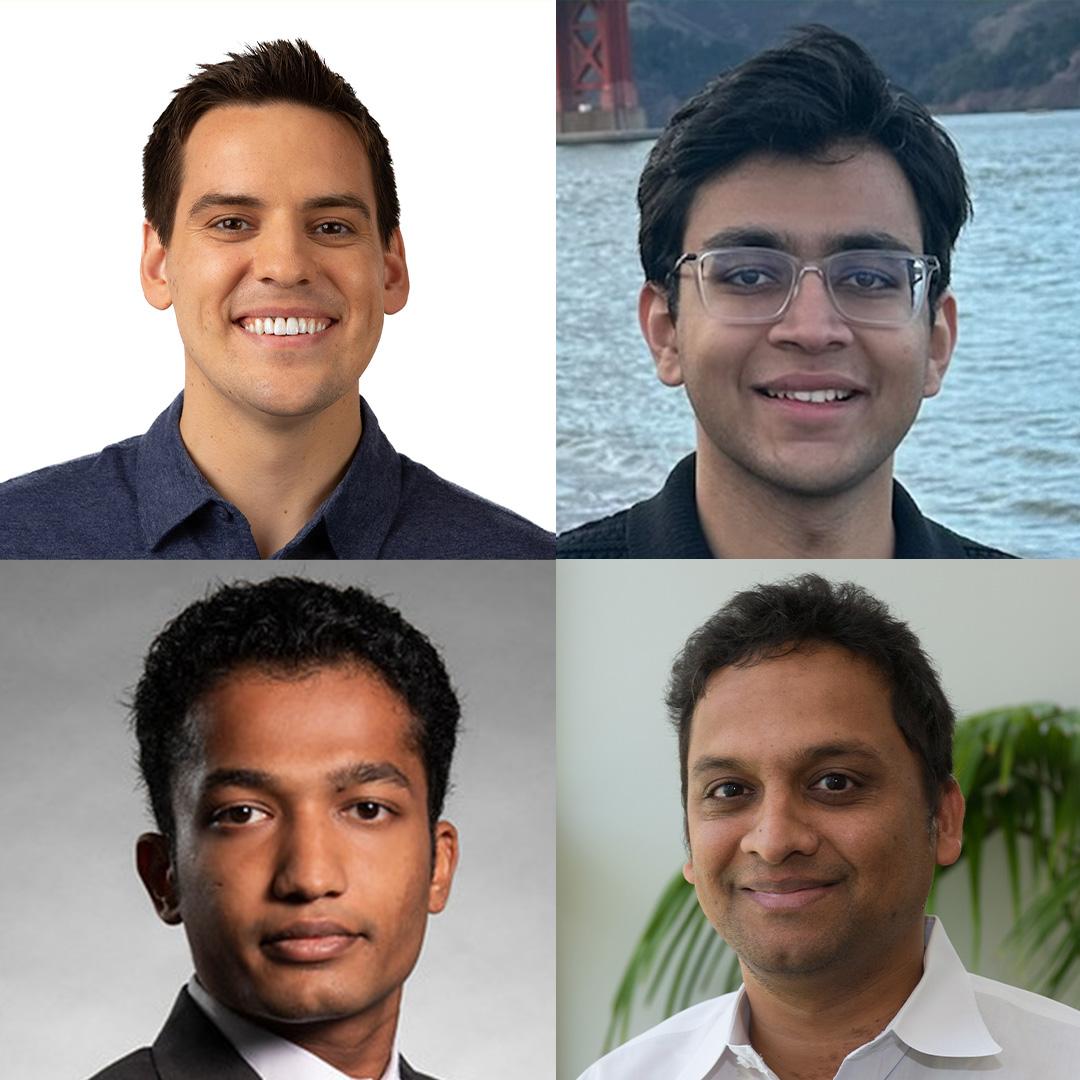

The benchmark, named VideoConviction, utilizes hundreds of video clips where each influencer’s recommendation—whether to buy, sell, or hold an asset—is meticulously labeled. The researchers, led by Michael Galarnyk, Ph.D. in Machine Learning, along with co-authors Veer Kejriwal, Agam Shah, and others, aimed to gauge both the message conveyed and the influencer’s conviction, which is assessed through their tone, delivery, and facial expressions.

This initiative represents a significant advancement in the intersection of finance and AI. The team, which includes co-authors from various esteemed institutions such as Stanford University and École Polytechnique, gathered a diverse array of video content to create a comprehensive dataset. Each clip was analyzed not only for its content but also for the emotional weight behind the statements made by the influencers.

Insights into AI Performance in Financial Contexts

“Our work shows that financial reasoning remains a challenge for even the most advanced models,” stated Michael Galarnyk. He emphasized that while multimodal inputs—those combining various forms of data, such as video and audio—improve performance, significant limitations persist. For example, AI often struggles with tasks requiring the differentiation between casual conversation and substantive financial analysis.

The findings are particularly relevant given the increasing reliance on social media for financial advice. The influence of these digital personalities has prompted a need for more robust AI tools capable of understanding complex financial discussions. As Sudheer Chava, Alton M. Costley Chair and professor of Finance at Georgia Tech, noted, “Understanding where these models fail is a first step toward building systems that can reason more reliably in high-stakes domains.”

The implications of this research extend beyond academic interest. With investors increasingly turning to digital platforms for guidance, the ability of AI to accurately interpret influencer advice could have critical consequences for market dynamics. This research not only sheds light on AI capabilities but also highlights the evolving landscape of financial decision-making in the digital age.

As the study progresses, the team hopes to refine these models further, contributing to the development of AI systems that can navigate the complexities of financial reasoning with greater accuracy and reliability. The ongoing evaluation of tools like VideoConviction will be essential in paving the way for AI’s future role in finance and investment strategies.

-

Technology5 months ago

Technology5 months agoDiscover the Top 10 Calorie Counting Apps of 2025

-

Health2 months ago

Health2 months agoBella Hadid Shares Health Update After Treatment for Lyme Disease

-

Health3 months ago

Health3 months agoErin Bates Shares Recovery Update Following Sepsis Complications

-

Technology4 months ago

Technology4 months agoDiscover How to Reverse Image Search Using ChatGPT Effortlessly

-

Technology1 month ago

Technology1 month agoDiscover 2025’s Top GPUs for Exceptional 4K Gaming Performance

-

Technology2 months ago

Technology2 months agoElectric Moto Influencer Surronster Arrested in Tijuana

-

Technology5 months ago

Technology5 months agoMeta Initiates $60B AI Data Center Expansion, Starting in Ohio

-

Technology5 months ago

Technology5 months agoRecovering a Suspended TikTok Account: A Step-by-Step Guide

-

Health4 months ago

Health4 months agoTested: Rab Firewall Mountain Jacket Survives Harsh Conditions

-

Lifestyle5 months ago

Lifestyle5 months agoBelton Family Reunites After Daughter Survives Hill Country Floods

-

Technology4 months ago

Technology4 months agoHarmonic Launches AI Chatbot App to Transform Mathematical Reasoning

-

Technology3 months ago

Technology3 months agoUncovering the Top Five Most Challenging Motorcycles to Ride