Health

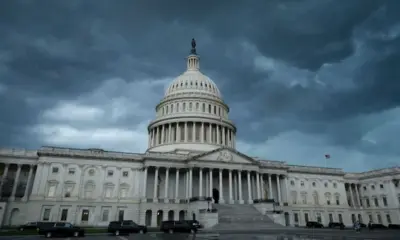

ETF Experts Discuss Regulatory Impact on Investors Amid Trump 2.0

The exchange-traded fund (ETF) industry is navigating the regulatory landscape under the current Trump administration, as key figures within the sector voice their insights on the effects of these changes. In a recent discussion, Sal Gilbertie from Teucrium Trading and Eric Pan of the Investment Company Institute (ICI) shared their perspectives during an interview with Dominic Chu of CNBC.

These experts emphasized that regulatory developments in Washington, D.C., are reshaping the ETF market, influencing both the industry’s operational framework and investors’ returns. The conversation highlighted the pressing need for clarity in regulation to foster growth and investor confidence.

Regulatory Changes and Their Implications

The dialogue between Gilbertie and Pan centered on how recent policy shifts could potentially redefine the ETF landscape. As the Trump administration continues to implement its agenda, both experts expressed concerns about the unpredictability of regulations that could affect fund managers and investors alike.

Gilbertie pointed out that the lack of consistency in regulatory measures creates challenges for ETF providers. “Investors need to know that the landscape is stable,” he noted, stressing that regulatory clarity is essential for long-term investment strategies. The conversation underscored the importance of adhering to guidelines that not only protect investors but also promote market efficiency.

Pan added that the ETF industry has shown resilience, but ongoing regulatory uncertainty may impede growth. He stated, “The industry has adapted well, but we need to ensure that new regulations do not stifle innovation.” His remarks reflect a broader concern that overly restrictive regulations could limit the ability of ETFs to provide diverse investment options to the public.

Impact on Investors’ Bottom Lines

The implications of regulatory changes extend beyond the industry itself, directly impacting investors’ portfolios. Both Gilbertie and Pan highlighted that any adverse shift in policy could result in increased costs for ETF providers, which in turn may affect the fees charged to investors. They emphasized the necessity for regulators to consider the potential consequences of their decisions on everyday investors.

The discussion also touched upon the importance of investor education in navigating the evolving landscape. Gilbertie remarked, “Investors must be informed about how regulatory changes can impact their investments.” He encouraged a proactive approach to understanding these developments, suggesting that investors stay engaged with industry news and regulatory updates.

Overall, the conversation between Gilbertie and Pan provided valuable insights into the current state of the ETF industry under the Trump administration. Their perspectives highlighted the critical balance between necessary regulation and the need for a thriving investment ecosystem. As the regulatory environment continues to evolve, both industry leaders and investors alike will need to remain vigilant to ensure that the ETF market can continue to grow and adapt.

-

Technology5 months ago

Technology5 months agoDiscover the Top 10 Calorie Counting Apps of 2025

-

Health2 months ago

Health2 months agoBella Hadid Shares Health Update After Treatment for Lyme Disease

-

Health3 months ago

Health3 months agoErin Bates Shares Recovery Update Following Sepsis Complications

-

Technology4 months ago

Technology4 months agoDiscover How to Reverse Image Search Using ChatGPT Effortlessly

-

Technology1 month ago

Technology1 month agoDiscover 2025’s Top GPUs for Exceptional 4K Gaming Performance

-

Technology2 months ago

Technology2 months agoElectric Moto Influencer Surronster Arrested in Tijuana

-

Technology5 months ago

Technology5 months agoMeta Initiates $60B AI Data Center Expansion, Starting in Ohio

-

Technology5 months ago

Technology5 months agoRecovering a Suspended TikTok Account: A Step-by-Step Guide

-

Health4 months ago

Health4 months agoTested: Rab Firewall Mountain Jacket Survives Harsh Conditions

-

Lifestyle5 months ago

Lifestyle5 months agoBelton Family Reunites After Daughter Survives Hill Country Floods

-

Technology4 months ago

Technology4 months agoHarmonic Launches AI Chatbot App to Transform Mathematical Reasoning

-

Technology3 months ago

Technology3 months agoUncovering the Top Five Most Challenging Motorcycles to Ride