Technology

Trump’s Military Maneuvers Boost Defense ETF with 61% Surge

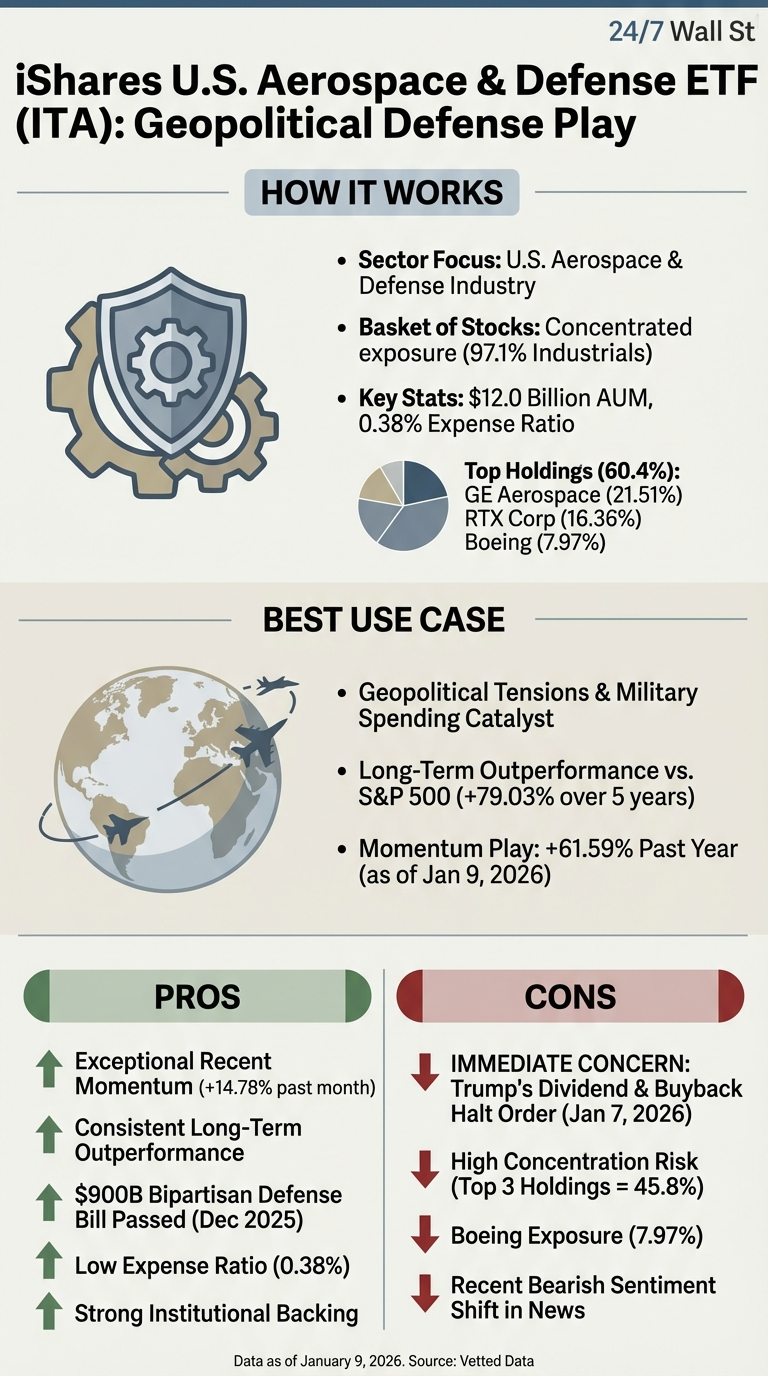

The iShares U.S. Aerospace & Defense ETF (NYSEARCA: ITA) has experienced a significant surge of **61%** over the past year, driven by former President **Donald Trump**’s assertive military strategies. As discussions about military options for **Greenland** and the U.S. presence in **Venezuela** gain momentum, defense spending is expected to accelerate, presenting a potential opportunity for investors.

The ITA ETF currently holds approximately **$12 billion** in assets and features a **0.38%** expense ratio. It provides concentrated exposure to the aerospace and defense sectors, with **97%** of its holdings in industrials. The top stocks within the ETF include **GE Aerospace** at **21.5%**, **RTX** at **16.4%**, and **Boeing** at **8%**. Smaller positions in companies like **Rocket Lab** and **Kratos Defense** further enhance its portfolio by tapping into emerging defense technologies. Notably, the fund has risen by **14.8%** in just the past month, reflecting the increasing geopolitical tensions.

The Geopolitical Catalyst for Growth

Trump’s recent military maneuvers have created a macroeconomic environment favorable for defense stocks. The administration is reportedly considering military action to acquire **Greenland**, maintaining U.S. troops in **Venezuela**, and discussing strategic interests in the **Panama Canal**. In a recent statement, White House Press Secretary **Karoline Leavitt** emphasized that “utilizing the U.S. military is always an option” regarding the acquisition of Greenland. This shift in strategy could lead to increased demand for defense hardware and logistics.

The **$900 billion** defense authorization bill passed in December 2022 establishes a baseline for funding, but additional appropriations are likely to follow new military operations. Investors are advised to monitor Congressional defense hearings and quarterly Pentagon procurement announcements closely. These factors will be crucial in assessing future defense budget amendments and the administration’s territorial priorities.

Dividend Freeze: A Double-Edged Sword

On January 7, 2023, Trump issued an order banning dividends and stock buybacks for defense contractors. This controversial policy aims to redirect corporate capital towards production capacity rather than shareholder payouts. Trump criticized defense companies for prioritizing shareholder returns over expanding production facilities, declaring on **Truth Social** that he “will not permit” such payments until companies enhance their manufacturing capabilities.

While this move initially led to a decline in defense contractor stock prices, it does not impact government contracts or overall earnings potential. Instead, it encourages contractors to reinvest in their operations, which could ultimately strengthen future growth prospects.

For those seeking alternative investments with less concentration risk, the **SPDR S&P Aerospace & Defense ETF** (NYSEARCA: XAR) offers a different approach. Unlike ITA, which is weighted by market capitalization, XAR employs an equal-weighting strategy that balances exposure across various defense contractors. XAR has a slightly lower **0.35%** expense ratio, allowing for a more diversified investment in the sector.

Investors should remain vigilant regarding whether Trump’s military ambitions result in supplementary defense appropriations. The dividend freeze may, in fact, fortify long-term fundamentals by compelling capital allocation towards productive capacity expansion.

As always, investors are encouraged to consider how these developments align with their overall investment strategies and retirement income plans. The transition from accumulating wealth to generating income in retirement remains a critical focus for many, and resources like the **Definitive Guide to Retirement Income** can provide valuable insights into making informed financial decisions.

-

Science2 months ago

Science2 months agoNostradamus’ 2026 Predictions: Star Death and Dark Events Loom

-

Science2 months ago

Science2 months agoBreakthroughs and Challenges Await Science in 2026

-

Technology3 months ago

Technology3 months agoOpenAI to Implement Age Verification for ChatGPT by December 2025

-

Technology8 months ago

Technology8 months agoDiscover the Top 10 Calorie Counting Apps of 2025

-

Technology6 months ago

Technology6 months agoElectric Moto Influencer Surronster Arrested in Tijuana

-

Health6 months ago

Health6 months agoBella Hadid Shares Health Update After Treatment for Lyme Disease

-

Health6 months ago

Health6 months agoAnalysts Project Stronger Growth for Apple’s iPhone 17 Lineup

-

Technology3 months ago

Technology3 months agoTop 10 Penny Stocks to Watch in 2026 for Strong Returns

-

Health6 months ago

Health6 months agoJapanese Study Finds Rose Oil Can Increase Brain Gray Matter

-

Science5 months ago

Science5 months agoStarship V3 Set for 2026 Launch After Successful Final Test of Version 2

-

Education6 months ago

Education6 months agoHarvard Secures Court Victory Over Federal Funding Cuts

-

Health6 months ago

Health6 months agoErin Bates Shares Recovery Update Following Sepsis Complications