Health

Trump Blames Powell for Soaring US Interest Costs

President Donald Trump has intensified his campaign against Jerome Powell, the chair of the Federal Reserve, alleging that his leadership is costing the United States “hundreds of billions of dollars” by failing to reduce interest rates. In a handwritten note posted on Truth Social last month, Trump criticized Powell, stating, “You have cost the USA a fortune and continue to do so.” He further claimed that if the Federal Reserve “were doing their job properly, our Country would be saving Trillions of Dollars in Interest Cost.”

This focus on interest rates comes amid rising concern over the nation’s increasing interest payments on its federal debt. For the first time in history, interest payments are projected to approach $1 trillion in the current fiscal year. The president recently signed a significant spending bill that is expected to add over $3 trillion to the deficit over the next decade, which could further elevate interest rates.

Moody’s has also downgraded the US debt, citing the escalating ratios of government debt and interest payments as contributing factors. Despite Trump’s efforts to pressure the Federal Reserve into lowering rates, experts caution that such actions may not alleviate the country’s interest payment burden significantly. The federal funds rate is just one of many factors that influence interest rates on federal debt, which consists of various Treasury securities with differing maturities.

According to Shai Akabas, vice president of economic policy at the Bipartisan Policy Center, “It seems to be an easier lever to pull for those who want to impact either interest costs on the federal debt or economic growth. But it doesn’t mean that action by the Fed will result in the outcome the president or others may want.”

Interest costs for the US have surged in recent years, driven by both the growing national debt and a rise in interest rates following a prolonged period of exceptionally low rates aimed at combating inflation. In the fiscal year of 2020, the US spent $346 billion on interest payments. This figure is projected to rise to $952 billion in the current fiscal year and is expected to exceed $1 trillion in the next, according to the Congressional Budget Office.

Interest payments have become the second-largest expenditure category in the federal budget, surpassing Medicare and defense spending in fiscal year 2024, with only Social Security taking a larger share. Currently, approximately 18 cents of every dollar in tax revenue is allocated to servicing interest on the debt. By the end of the next decade, this figure is anticipated to rise to around 25 cents.

While a reduction in the federal funds rate could lower rates on short-term securities, it may not have the same effect on longer-duration Treasury bonds. In fact, a significant cut could potentially lead to higher long-term rates, as it might spur inflation or cause investors to seek longer-term securities to secure better yields. As noted by Marc Goldwein, senior policy director at the Committee for a Responsible Federal Budget, “The Federal Reserve only has so much power to lower those interest rates. There’s no guarantee that the Fed cutting rates will reduce interest payments at all.”

Experts suggest that if Trump is genuinely concerned about reducing interest payments, he could focus on lowering the annual deficit. This approach, however, would likely require politically challenging changes to taxes and spending priorities. While Trump’s current agenda aims for historic reductions in federal spending on safety net programs, the proposed tax cuts could exacerbate the deficit, counteracting any intended savings.

Goldwein emphasized, “If your concern is the hundreds of billions of dollars we’re adding to the deficit from higher interest costs, the solution is to enact policies that are deficit reducing, not deficit increasing.” As the debate over fiscal policy continues, the implications of these interest costs will be felt across the economy and in the federal budget for years to come.

-

Technology4 months ago

Technology4 months agoDiscover the Top 10 Calorie Counting Apps of 2025

-

Health2 months ago

Health2 months agoBella Hadid Shares Health Update After Treatment for Lyme Disease

-

Health3 months ago

Health3 months agoErin Bates Shares Recovery Update Following Sepsis Complications

-

Technology3 weeks ago

Technology3 weeks agoDiscover 2025’s Top GPUs for Exceptional 4K Gaming Performance

-

Technology2 months ago

Technology2 months agoElectric Moto Influencer Surronster Arrested in Tijuana

-

Technology4 months ago

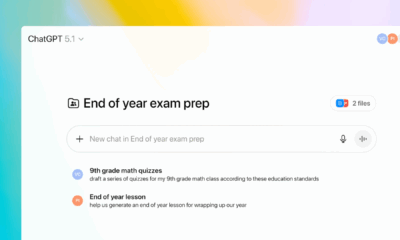

Technology4 months agoDiscover How to Reverse Image Search Using ChatGPT Effortlessly

-

Technology4 months ago

Technology4 months agoMeta Initiates $60B AI Data Center Expansion, Starting in Ohio

-

Technology4 months ago

Technology4 months agoRecovering a Suspended TikTok Account: A Step-by-Step Guide

-

Health4 months ago

Health4 months agoTested: Rab Firewall Mountain Jacket Survives Harsh Conditions

-

Lifestyle4 months ago

Lifestyle4 months agoBelton Family Reunites After Daughter Survives Hill Country Floods

-

Technology3 months ago

Technology3 months agoUncovering the Top Five Most Challenging Motorcycles to Ride

-

Technology4 weeks ago

Technology4 weeks agoDiscover the Best Wireless Earbuds for Every Lifestyle