Health

Global Markets React as Economic Data Surprises Analysts on August 1

Global markets experienced significant fluctuations on August 1, 2025, following the release of unexpected economic data that caught analysts off guard. The latest figures indicated stronger-than-anticipated growth in the United States, coupled with a notable improvement in the Eurozone’s economic indicators. This news led to a surge in investor confidence, prompting a rally in stock markets across multiple regions.

In the United States, the Gross Domestic Product (GDP) growth rate for the second quarter was revised upward to 3.5%, surpassing analysts’ expectations of 2.8%. This revision is attributed to robust consumer spending and increased business investments, as reported by the U.S. Bureau of Economic Analysis. The positive trend in economic performance has led to speculation regarding potential adjustments in monetary policy by the Federal Reserve.

Market Response and Regional Impact

Following the release of the economic data, major U.S. stock indices responded positively. The S&P 500 rose by 1.2%, while the Dow Jones Industrial Average saw an increase of 1.5%. Analysts noted that the data provided a much-needed boost to investor sentiment, particularly in technology and consumer goods sectors.

Meanwhile, in the Eurozone, economic indicators showed signs of recovery. The Eurozone’s GDP growth was reported at 2.9% for the same quarter, a figure that exceeded forecasts of 2.4%. This improvement is largely credited to increased exports and a rebound in the service sector, as highlighted by Eurostat.

Asian markets also mirrored the positive trends, with Japan’s Nikkei index climbing 1.8% by the end of the trading day. Market analysts anticipate that this upward momentum could continue, particularly if economic conditions in the region stabilize further.

Analyst Insights and Future Projections

Analysts are now reevaluating their forecasts in light of the surprising economic performance. Sarah Thompson, an economist at the International Monetary Fund, stated, “The data indicates a stronger recovery than previously thought. If this trend continues, we may see a shift in monetary policy earlier than expected.”

Furthermore, the unexpected surge in growth has raised questions about inflationary pressures. The Federal Reserve and the European Central Bank may have to navigate a complex economic landscape as they balance growth with inflation control.

Investors are advised to remain vigilant as more economic data becomes available in the coming weeks. The market’s response to these developments will be closely monitored, particularly as policymakers assess their next moves.

Overall, the economic data released on August 1 has reinvigorated markets globally, showcasing resilience in both the United States and the Eurozone. As analysts digest this information, the implications for future monetary policy and investment strategies will unfold in the months ahead.

-

Technology4 months ago

Technology4 months agoDiscover the Top 10 Calorie Counting Apps of 2025

-

Health2 months ago

Health2 months agoBella Hadid Shares Health Update After Treatment for Lyme Disease

-

Health3 months ago

Health3 months agoErin Bates Shares Recovery Update Following Sepsis Complications

-

Technology3 weeks ago

Technology3 weeks agoDiscover 2025’s Top GPUs for Exceptional 4K Gaming Performance

-

Technology2 months ago

Technology2 months agoElectric Moto Influencer Surronster Arrested in Tijuana

-

Technology4 months ago

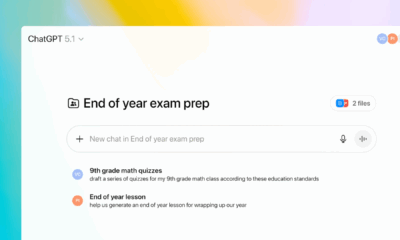

Technology4 months agoDiscover How to Reverse Image Search Using ChatGPT Effortlessly

-

Technology4 months ago

Technology4 months agoMeta Initiates $60B AI Data Center Expansion, Starting in Ohio

-

Technology4 months ago

Technology4 months agoRecovering a Suspended TikTok Account: A Step-by-Step Guide

-

Health4 months ago

Health4 months agoTested: Rab Firewall Mountain Jacket Survives Harsh Conditions

-

Lifestyle4 months ago

Lifestyle4 months agoBelton Family Reunites After Daughter Survives Hill Country Floods

-

Technology3 months ago

Technology3 months agoUncovering the Top Five Most Challenging Motorcycles to Ride

-

Technology4 weeks ago

Technology4 weeks agoDiscover the Best Wireless Earbuds for Every Lifestyle