Health

Global Markets Rally as Investors React to Economic Data

On September 15, 2025, global markets experienced a significant rally following the release of encouraging economic data. Major indices in the United States, including the Dow Jones Industrial Average and the S&P 500, surged as investors responded positively to hints of economic recovery. This shift reflects growing confidence among investors regarding the stability of economic growth.

The Dow climbed by over 300 points, closing at approximately 35,500, while the S&P 500 rose by 1.2%, reaching 4,600. The Nasdaq Composite also saw gains, increasing by 1.5% to close at 15,000. Analysts noted that this upward trend was driven by a combination of strong corporate earnings reports and positive consumer sentiment.

Investor Confidence Boosted by Economic Indicators

The rally followed the announcement of improved consumer spending figures, which rose by 0.8% in August, indicating a robust economic environment. Additionally, the unemployment rate dropped to 4.2%, signaling a tightening labor market. These indicators prompted investors to reassess their positions in light of potential growth opportunities.

According to CNBC, market analysts are optimistic about the Federal Reserve’s future actions. The central bank is expected to maintain its accommodative monetary policy until inflation shows signs of stabilizing. This approach has encouraged riskier investments, contributing to the upward momentum in equity markets.

Sector Performances and Future Outlook

Technology stocks led the charge, with major players like Apple and Microsoft posting impressive gains. Both companies reported strong quarterly earnings, further fueling investor enthusiasm. Meanwhile, energy stocks also saw an uptick as crude oil prices stabilized around $85 per barrel.

Looking ahead, analysts speculate that a continued focus on economic indicators will shape market dynamics. The upcoming meeting of the Federal Reserve later this month will be closely monitored for any shifts in policy that could impact market conditions.

Overall, the positive data has set a favorable tone for the markets, with many investors feeling more secure about their portfolios. As September progresses, the focus will remain on how these developments influence trading strategies and economic forecasts.

-

Technology4 months ago

Technology4 months agoDiscover the Top 10 Calorie Counting Apps of 2025

-

Health2 months ago

Health2 months agoBella Hadid Shares Health Update After Treatment for Lyme Disease

-

Health3 months ago

Health3 months agoErin Bates Shares Recovery Update Following Sepsis Complications

-

Technology3 weeks ago

Technology3 weeks agoDiscover 2025’s Top GPUs for Exceptional 4K Gaming Performance

-

Technology2 months ago

Technology2 months agoElectric Moto Influencer Surronster Arrested in Tijuana

-

Technology4 months ago

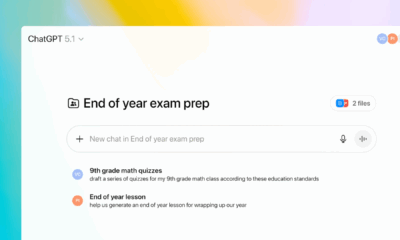

Technology4 months agoDiscover How to Reverse Image Search Using ChatGPT Effortlessly

-

Technology4 months ago

Technology4 months agoMeta Initiates $60B AI Data Center Expansion, Starting in Ohio

-

Technology4 months ago

Technology4 months agoRecovering a Suspended TikTok Account: A Step-by-Step Guide

-

Health4 months ago

Health4 months agoTested: Rab Firewall Mountain Jacket Survives Harsh Conditions

-

Lifestyle4 months ago

Lifestyle4 months agoBelton Family Reunites After Daughter Survives Hill Country Floods

-

Technology3 months ago

Technology3 months agoUncovering the Top Five Most Challenging Motorcycles to Ride

-

Technology4 weeks ago

Technology4 weeks agoDiscover the Best Wireless Earbuds for Every Lifestyle