Technology

AMD Reports Strong Q3 Growth but Stock Dips Due to Margin Concerns

Advanced Micro Devices Inc. (AMD) announced significant increases in revenue and profit for the third quarter of 2023, driven by its expansion into the artificial intelligence data center market. Despite this positive financial performance, the company’s stock experienced a decline in late trading, attributed to disappointing margin guidance.

AMD reported earnings of $1.20 per share, surpassing the $1.16 forecast set by analysts. The company’s revenue for the quarter surged 36% to $9.25 billion, exceeding the consensus estimate of $8.74 billion. Overall, AMD recorded a net profit of $1.24 billion, a significant increase from $771 million in the same quarter the previous year.

Revenue Guidance and Margin Concerns

Looking ahead, AMD anticipates fourth-quarter revenue to reach approximately $9.6 billion, which suggests a growth rate of around 25%. This projection exceeds the market’s expectation of $9.15 billion. However, the company’s adjusted gross margin forecast of 54.5% aligned with Wall Street’s consensus disappointed investors, leading to a 3% drop in stock price during extended trading, following a nearly 4% decline earlier in the day.

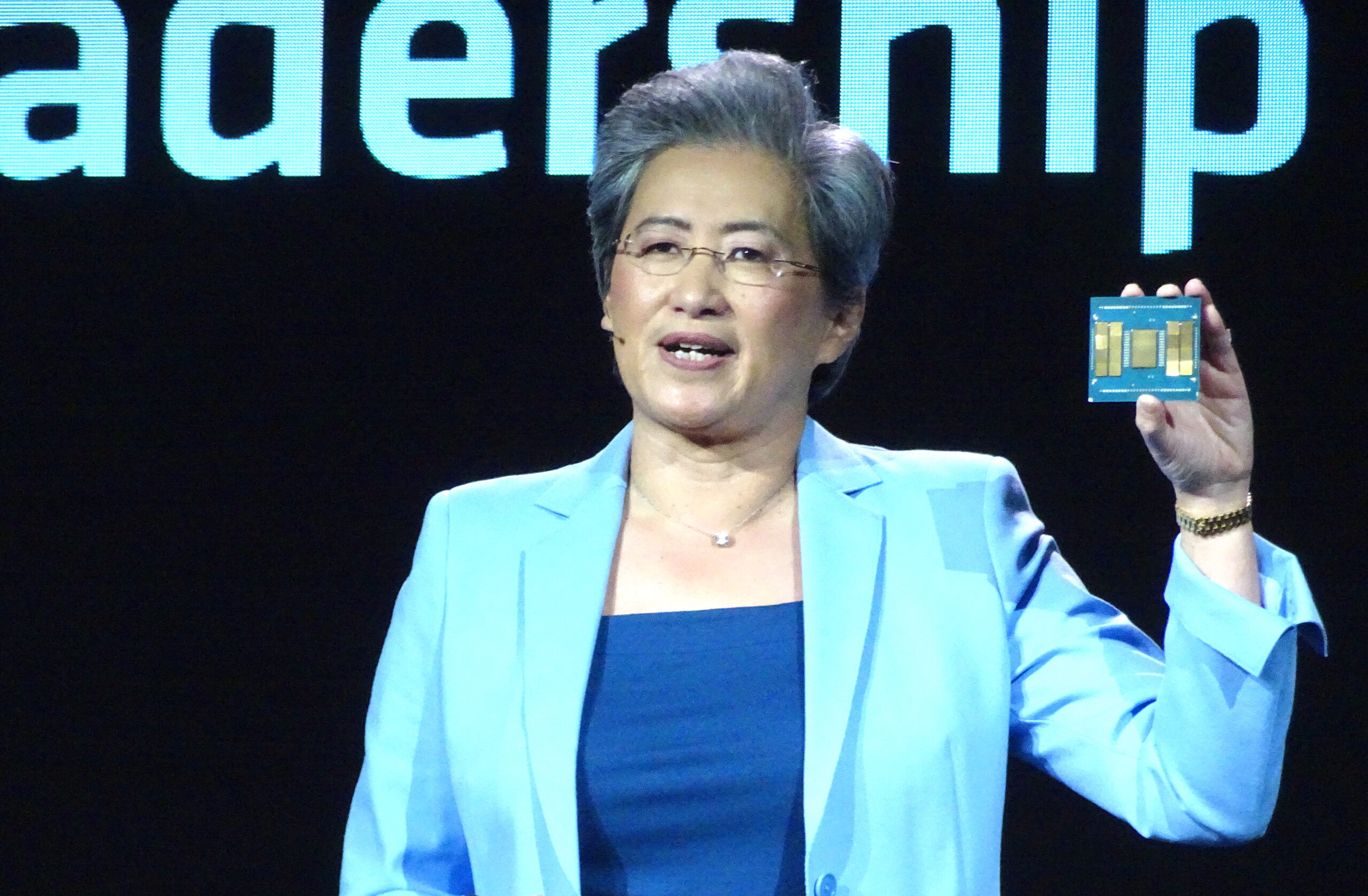

AMD’s Chair and Chief Executive, Lisa Su, described the results as “outstanding,” emphasizing the record-breaking revenue and profitability. She highlighted that the figures reflect a broad-based demand for AMD’s high-performance EPYC and Ryzen processors, alongside rising interest in its Instinct AI accelerators.

AMD clarified that its current quarter revenue guidance does not factor in expected shipments of its Instinct MI308 processors to China. Although waivers from the U.S. government allow for these shipments, the company is awaiting clearance from the Department of Commerce for license applications, contributing to investor uncertainty.

Market Position and Future Prospects

Despite the recent stock decline, AMD’s stock has increased by 107% year-to-date, in contrast to a 21% gain for the broader Nasdaq index. This surge can be attributed to AMD’s efforts to compete with Nvidia Corp. in the lucrative graphics processing unit market, which is essential for AI workloads.

Significant developments include Oracle Corp.‘s announcement to deploy 50,000 new AMD Instinct MI450 AI processors in its cloud services starting next year. Additionally, OpenAI is planning to deploy six gigawatts of AMD’s processors over several years, beginning with an initial one gigawatt deployment. OpenAI is also considering acquiring a 10% stake in AMD through a potential purchase of 160 million shares.

Analyst Gil Luria from D.A. Davidson noted that AMD is approaching a pivotal moment, contingent upon operational execution and the successful release of high-performance chips. He stated, “If it does that, the sales are there waiting. There’s significant demand out there for an Nvidia alternative.”

AMD’s data center division, encompassing its AI accelerators and standard EPYC processors, generated $4.34 billion in revenue during the quarter, marking a 22% increase from the previous year and exceeding the expected $4.13 billion. However, the unit’s operating income of $1.07 billion fell short of predictions by approximately 14%, as margins dropped to 25% from 29% a year prior.

In the client computing sector, AMD reported revenue of $2.75 billion, a 46% increase and well above the anticipated $2.61 billion. The gaming segment also performed strongly, with revenues reaching $1.3 billion, up 181% year-over-year and surpassing the consensus estimate of $1.05 billion.

Despite the mixed signals from the latest earnings report, AMD remains poised for growth as it navigates the competitive landscape of the AI and data center markets.

-

Technology4 months ago

Technology4 months agoDiscover the Top 10 Calorie Counting Apps of 2025

-

Health2 months ago

Health2 months agoBella Hadid Shares Health Update After Treatment for Lyme Disease

-

Health3 months ago

Health3 months agoErin Bates Shares Recovery Update Following Sepsis Complications

-

Technology4 weeks ago

Technology4 weeks agoDiscover 2025’s Top GPUs for Exceptional 4K Gaming Performance

-

Technology2 months ago

Technology2 months agoElectric Moto Influencer Surronster Arrested in Tijuana

-

Technology4 months ago

Technology4 months agoDiscover How to Reverse Image Search Using ChatGPT Effortlessly

-

Technology4 months ago

Technology4 months agoMeta Initiates $60B AI Data Center Expansion, Starting in Ohio

-

Technology4 months ago

Technology4 months agoRecovering a Suspended TikTok Account: A Step-by-Step Guide

-

Health4 months ago

Health4 months agoTested: Rab Firewall Mountain Jacket Survives Harsh Conditions

-

Lifestyle4 months ago

Lifestyle4 months agoBelton Family Reunites After Daughter Survives Hill Country Floods

-

Technology3 months ago

Technology3 months agoUncovering the Top Five Most Challenging Motorcycles to Ride

-

Technology4 months ago

Technology4 months agoHarmonic Launches AI Chatbot App to Transform Mathematical Reasoning