Health

U.S. Hospitals Struggle with Thin Margins Amid Rising Costs

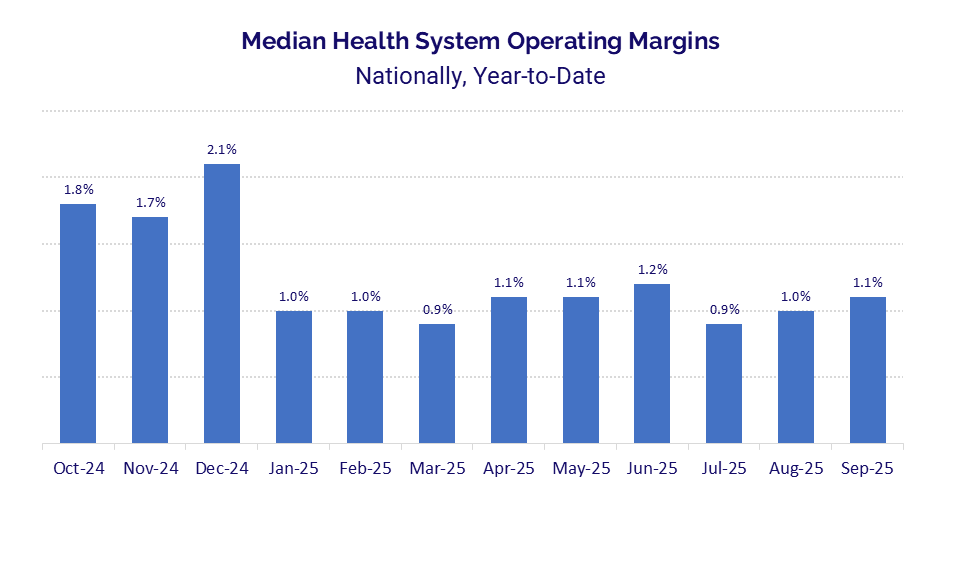

U.S. healthcare organizations are grappling with significant financial challenges as they close the third quarter of 2025. Operating margins remain perilously thin, with data indicating a slight increase to 1.1% in September. This figure highlights the ongoing struggle against rising expenses that continue to outpace revenue growth.

Expense Pressures Intensify Across Hospitals

The primary factor affecting hospital financial performance has been the steep rise in non-labor expenses, particularly in the areas of supplies and pharmaceuticals. According to Strata Decision Technology, drug expenses surged by 12.8% year-over-year (YOY), while supply costs increased by 12.1% during the same period. These substantial hikes resulted in a total non-labor expense growth of 9.3% YOY, significantly higher than the 5.0% increase in total labor costs.

Overall, total hospital expenses rose 7.5% YOY, underscoring the relentless financial pressures that hospitals are facing. Disparities in these expenses were evident across different regions, with hospitals in the Midwest experiencing the most significant YOY increase in drug expenses at 17.3%, followed closely by the West at 15.7%.

“Operating margins have faltered throughout the first three quarters of 2025 as healthcare organizations feel the full weight of rising expenses,” stated Steve Wasson, Chief Data and Intelligence Officer at Strata Decision Technology. He emphasized the need for organizations to manage expenses rigorously to maintain performance amid challenging economic conditions.

Outpatient Care Drives Revenue Growth

While expenses have surged, there has been a noticeable shift in patient demand towards outpatient care, which has contributed to revenue increases. Nationally, outpatient visits rose by 9.8% YOY in September, with the South and Midwest leading the charge. Inpatient admissions also saw a 5.3% YOY increase, while emergency visits experienced a slight decline of 0.5%.

Mirroring these trends, gross operating revenue increased by 11.4% YOY, driven largely by a 12.8% increase in outpatient revenue and a 9.8% rise in inpatient revenue. These figures reflect a significant adaptation within the healthcare sector towards more efficient care models.

In a positive development for physician practices, there are early signs of financial relief. The median investment required to support practice operations decreased YOY for the first time in 2025, with the median investment per physician full-time equivalent (FTE) falling to $311,264 in the third quarter, a decrease of 4.7% from the previous quarter and 1.8% from Q3 2024.

Despite the high median total expense per physician FTE, which stands at around $1.1 million (up 3.9% YOY), there was a slight decrease of 1.3% compared to Q2 2025.

The data presented here draws from over 650 hospitals and 135,000 physicians, covering approximately 25% of all provider spending in U.S. healthcare, utilizing the StrataSphere® database and Comparative Analytics.

As hospitals navigate these financial pressures, the focus remains on balancing expense management while adapting to changing patient care trends. The ongoing adjustments in practice operations and service delivery models will be critical as the healthcare landscape continues to evolve.

-

Technology4 months ago

Technology4 months agoDiscover the Top 10 Calorie Counting Apps of 2025

-

Health2 months ago

Health2 months agoBella Hadid Shares Health Update After Treatment for Lyme Disease

-

Health3 months ago

Health3 months agoErin Bates Shares Recovery Update Following Sepsis Complications

-

Technology4 weeks ago

Technology4 weeks agoDiscover 2025’s Top GPUs for Exceptional 4K Gaming Performance

-

Technology2 months ago

Technology2 months agoElectric Moto Influencer Surronster Arrested in Tijuana

-

Technology4 months ago

Technology4 months agoDiscover How to Reverse Image Search Using ChatGPT Effortlessly

-

Technology4 months ago

Technology4 months agoMeta Initiates $60B AI Data Center Expansion, Starting in Ohio

-

Technology4 months ago

Technology4 months agoRecovering a Suspended TikTok Account: A Step-by-Step Guide

-

Health4 months ago

Health4 months agoTested: Rab Firewall Mountain Jacket Survives Harsh Conditions

-

Lifestyle4 months ago

Lifestyle4 months agoBelton Family Reunites After Daughter Survives Hill Country Floods

-

Technology3 months ago

Technology3 months agoUncovering the Top Five Most Challenging Motorcycles to Ride

-

Technology4 months ago

Technology4 months agoHarmonic Launches AI Chatbot App to Transform Mathematical Reasoning